Will Insurance Cover Semaglutide For Weight Loss?

Will Insurance Cover Semaglutide For Weight Loss? In recent years, there has been a growing interest in Semaglutide as a weight loss treatment.

Semaglutide is a medication that was originally developed to treat type 2 diabetes, but it has also shown promising results in helping individuals lose weight. Some of the popular brand names are Ozempic & Wegovy.

However, one of the biggest challenges for individuals seeking Semaglutide treatment is insurance coverage. Insurance coverage plays a crucial role in making weight loss treatments accessible and affordable for individuals who need them.

In this article, we will explore the importance of medical insurance coverage for weight loss treatments, specifically focusing on Semaglutide.

Introduction to Semaglutide Weight Loss Treatment

Semaglutide is a medication that belongs to a class of drugs called glucagon-like peptide-1 receptor agonists (GLP-1 RAs). It works by mimicking the effects of a hormone called glucagon-like peptide-1 (GLP-1), which helps regulate blood sugar levels and appetite. When used for weight loss, Semaglutide is typically administered as a once-weekly injection.

The benefits of Semaglutide treatment for weight loss are significant. Clinical trials have shown that individuals who took Semaglutide experienced greater weight loss compared to those who took a placebo. In fact, some participants lost up to 15% of their body weight. Semaglutide has also been shown to improve other health markers, such as blood pressure and cholesterol levels.

How Semaglutide Works for Weight Loss

Semaglutide works by increasing feelings of fullness and reducing appetite. It slows down the emptying of the stomach, which helps individuals feel satisfied with smaller portions of food. Additionally, Semaglutide may also have an impact on the brain’s reward system, reducing cravings for high-calorie foods.

Clinical studies have demonstrated the effectiveness of Semaglutide for weight loss. In one study, participants who took Semaglutide lost an average of 14.9% of their body weight, compared to 2.4% in the placebo group. These results were sustained over a 68-week period. However, it is important to note that individual results may vary.

While Semaglutide has shown promising results for weight loss, it is not without side effects. Common side effects include nausea, vomiting, diarrhea, and constipation. These side effects are usually mild and improve over time. However, there have been rare cases of more serious side effects, such as pancreatitis and thyroid tumors. It is important to discuss the potential risks and benefits of Semaglutide with a healthcare provider before starting treatment.

Insurance Coverage for Semaglutide Treatment

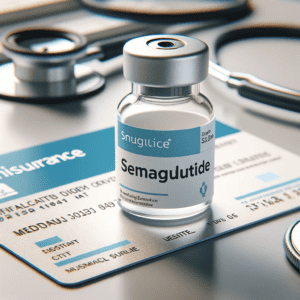

Insurance coverage for Semaglutide treatment can vary depending on the type of insurance plan and the specific policy. In general, there are three types of insurance plans that may cover Semaglutide: private health insurance, Medicare, and Medicaid.

Private health insurance plans may cover Semaglutide (best known as Ozempic and Wegovy), but coverage limitations and requirements may apply. Some insurance plans may require prior authorization before covering the medication. This means that the healthcare provider must submit a request to the insurance company explaining why Semaglutide is medically necessary for the individual.

Medicare, the federal health insurance program for individuals aged 65 and older, may cover Semaglutide for weight loss if certain criteria are met. Medicaid, the joint federal and state program that provides health coverage for low-income individuals, may also cover Semaglutide in some states.

Reasons Why Insurance Might Not Cover Ozempic & Wegovy Treatment

Wegovy Semaglutide Injection

While insurance coverage for Semaglutide is possible, there are several reasons why insurance companies may not cover the treatment.

One reason is the lack of FDA approval specifically for weight loss. Semaglutide is currently approved by the FDA for the treatment of type 2 diabetes, but not for weight loss. Insurance companies often rely on FDA approval when making coverage decisions. Without FDA approval for weight loss, insurance companies may be hesitant to cover Semaglutide.

Another reason is the cost of Semaglutide treatment. The average cost of Semaglutide can be quite high, especially for individuals without insurance coverage. Insurance companies may be reluctant to cover a medication that is expensive and may require long-term use.

Insurance company policies on weight loss treatments can also influence coverage decisions. Some insurance companies may have specific policies in place that limit coverage for weight loss treatments. These policies may require individuals to meet certain criteria, such as having a certain body mass index (BMI) or having tried and failed other weight loss methods before covering Semaglutide.

Lack of FDA Approval for Weight Loss

The lack of FDA approval specifically for weight loss is a significant barrier to insurance coverage for Semaglutide (Ozempic & Wegovy). The FDA approval process is a rigorous and lengthy process that involves evaluating the safety and effectiveness of a medication for a specific use.

Currently, Semaglutide is only approved by the FDA for the treatment of type 2 diabetes. In order for Semaglutide to be approved for weight loss, additional clinical trials and evidence would need to be submitted to the FDA. This process can take several years and requires significant resources.

However, it is worth noting that healthcare providers can still prescribe medications off-label, meaning they can prescribe a medication for a use that is not specifically approved by the FDA. Off-label prescribing is a common practice in medicine and is based on the healthcare provider’s clinical judgment and the available evidence.

Cost of Semaglutide Treatment

How Much Does Semaglutide Cost?

The cost of Semaglutide treatment can be a significant barrier for individuals seeking insurance coverage. The average cost of Semaglutide can range from several hundred to over a thousand dollars per month, depending on the dosage and the pharmacy.

However, there may be options available to help make Semaglutide (Ozempic & Wegovy) more affordable. Some pharmaceutical companies offer patient assistance programs or discounts for individuals who meet certain criteria, such as income eligibility. These programs can significantly reduce the out-of-pocket cost of Semaglutide.

Additionally, individuals with insurance coverage may be able to use their prescription drug benefits to help offset the cost of Semaglutide. It is important to check with the insurance company to understand the specific coverage and cost-sharing requirements.

Insurance Company Policies on Weight Loss Treatments

Insurance company policies on weight loss treatments can vary widely. Some insurance companies may have more lenient policies that cover a range of weight loss treatments, including medications like Semaglutide. Other insurance companies may have stricter policies that limit coverage to certain criteria, such as BMI or previous weight loss attempts.

Factors that influence insurance coverage decisions for weight loss treatments include the available evidence on the effectiveness of the treatment, the cost of the treatment, and the potential impact on overall healthcare costs. Insurance companies are often focused on providing coverage for treatments that are deemed medically necessary and cost-effective.

It is important for individuals seeking Semaglutide treatment to review their insurance policy and understand the specific coverage limitations and requirements. This can help individuals navigate the insurance process and increase their chances of obtaining coverage for Semaglutide.

Alternative Weight Loss Treatments Covered by Insurance

While Semaglutide may not be covered by insurance for weight loss, there are alternative weight loss treatments that may be covered. These treatments can include lifestyle interventions, such as diet and exercise programs, as well as other medications approved for weight loss.

Lifestyle interventions, such as working with a registered dietitian or participating in a structured weight loss program, are often covered by insurance. These interventions focus on making sustainable changes to diet and physical activity habits to promote weight loss.

There are also other medications that have been approved by the FDA for weight loss, such as phentermine/topiramate (Qsymia) and liraglutide (Saxenda). These medications work through different mechanisms than Semaglutide but have shown effectiveness in promoting weight loss. Insurance coverage for these medications may vary depending on the specific policy.

It is important to discuss alternative weight loss treatments with a healthcare provider to determine the best approach for individual needs and goals.

How to Appeal Insurance Denial for Semaglutide Treatment

Claim Denied

If insurance coverage for Semaglutide is denied, there are steps that individuals can take to appeal the decision. The appeals process can be complex and time-consuming, but it can be worth pursuing in order to obtain coverage for Semaglutide.

The first step in the appeals process is to review the denial letter from the insurance company. This letter should outline the specific reasons for the denial. Understanding the reasons for the denial can help individuals gather the necessary documentation and evidence to support their case.

The next step is to gather supporting documentation. This can include medical records, clinical studies, and letters of medical necessity from healthcare providers. It is important to provide as much evidence as possible to demonstrate the medical necessity of Semaglutide for weight loss.

Once all the necessary documentation is gathered, individuals can submit an appeal to the insurance company. It is important to follow the specific appeals process outlined by the insurance company, as each company may have different requirements and deadlines.

During the appeals process, it can be helpful to work with a healthcare provider or a patient advocate who is familiar with the insurance appeals process. They can provide guidance and support throughout the process.

Conclusion of Will Insurance Cover Semaglutide For Weight Loss?

In conclusion, insurance coverage plays a crucial role in making weight loss treatments accessible and affordable for individuals who need them. Semaglutide (Ozempic & Wegovy) is a promising weight loss treatment that has shown significant benefits in clinical trials. However, insurance coverage for Semaglutide can be challenging due to factors such as the lack of FDA approval for weight loss and the cost of treatment.

The future of Semaglutide weight loss treatment coverage is uncertain. As more evidence becomes available on the effectiveness and safety of Semaglutide for weight loss, there may be a greater push for insurance coverage. Additionally, advocacy efforts from healthcare providers, patient organizations, and individuals seeking Semaglutide treatment can help raise awareness and promote insurance coverage for weight loss treatments.

In the meantime, it is important for individuals seeking Semaglutide treatment to explore alternative weight loss treatments that may be covered by insurance. Lifestyle interventions and other FDA-approved weight loss medications can provide viable options for individuals looking to lose weight.

Advocating for insurance coverage for weight loss treatments is crucial in ensuring that individuals have access to the care they need. By raising awareness and advocating for policy changes, individuals can help make weight loss treatments more accessible and affordable for all.